Imagine if advertising functioned like a complex modern stock exchange, through which billions of dollars flowed electronically in transactions lasting fractions of a second.

Publishers would place their pages and videos in the exchange, specifying their “asks” — what they thought the adjacent ad spots were worth, based on the presumed value of the content and the people consuming it.

Advertisers would place “bids,” saying how much they were willing to pay to get their ads in front of individuals who matched desired attributes such as age range, gender, family status, income level, geography and interest in the advertiser’s type of product.

When the “bid” matched the “ask,” the ad would be placed seamlessly, and the money would flow from advertiser to publisher — with the exchange and a few other go-betweens taking their slivers.

The scenario isn’t imaginary. Chances are you’ve experienced the result of just such a transaction on your computer, tablet or smartphone, and perhaps even an electronic billboard, TV or radio.

Programmatic advertising — in which advertisements are bought, sold and placed through automated exchanges — is “a multibillion-dollar marketplace growing faster than search, video, or anything else for that matter,” advertising entrepreneur John Battelle wrote in a blog post in January.

For advertisers trying to sell products and services, the appeal of exchanges is easy to understand. For privacy advocates and some publishers, it’s easy to see why they are often suspicious. For all sides, it all has to do with how the technology works.

While ad exchanges account for a fraction of digital advertising today, their share is growing. An investment bank estimated last year that 35 percent of digital display advertisements were “biddable” in 2011, up from nothing — literally 0 percent — in 2007.

Those ads account for billions of dollars, and some experts predict that programmatic buying and selling will handle half or more of all digital advertising in years to come — in part because it’s much more efficient than the more laborious practices common today.

“A traditional advertising deal takes hundreds of emails, insertion orders, manual tagging and trafficking. Then there’s reporting, change orders, bill synching. You find out why an agency has 200 people just to execute buys,” said Mike Shehan, CEO of SpotXchange, a video ad exchange for which my company, Teeming Media, recently produced an 11-chapter white paper. “Programmatic advertising is the automation of all of that.”

The Technology Holds the Key

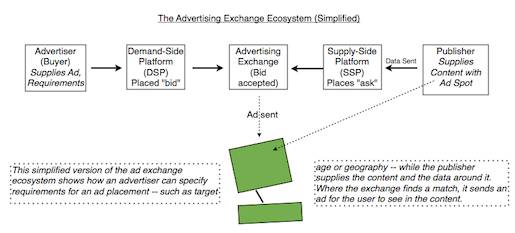

Advertising exchanges sit at the center of a complex ecosystem of technologies that on one end represent the advertising, or “buy” side — those looking to buy a spot in which to place an ad.

At the other end are the sellers like publishers who have content (such as a video or a web page) into which the ads will be inserted.

What differentiates the exchanges from other types of advertising insertion systems is their level of sophisticated, real-time decision-making.

They place the ads by correlating them to multiple factors, and can do so for almost every individual “impression” in real time.

An ad network, by contrast, tends to buy large swathes of impressions from a range of publishers up front then guarantee advertisers placements in those spots for a set fee.

The network may, for example, buy placements from a range of large publishers and smaller blogs in content about a specific subject such as cooking, then tell the advertiser that they can through the network reach people interested in cooking.

There are, of course, also “direct” deals — ones in which a salesperson from a publisher deals directly with an advertiser or their agency, and then receives and traffics the ads.

Publishers Get Less Skittish

Advertisers in recent months have become increasingly enamored with the exchanges because they seem to have a higher assurance of showing an ad to just the right person at just the right time with the right message that will entice him or her to buy.

Let’s say, for example, that a woman in a choice age bracket and geography has visited the IMDb page to learn more about a new movie.

What if the studio could then show her an ad about that movie while she’s looking for something to do on a subsequent evening?

If the ad’s on her phone, and she’s near a theater, even better. The advertiser can add location to the range of factors that makes the ad relevant.

It’s all done through a chain of tracking, usually via cookies, that gives a level of probability that a correct match is made. The higher the probability the factors match up well, and the more high value the content, the higher the price for the ad is likely to be.

While reputable publishers have been skittish about exchanges — suspecting they are auction systems that buyers use to try to pinch pennies — more have started to experiment with them.

Many ads in Google’s empire are sold through exchange systems, and both Facebook and Amazon last year announced they were launching exchange-based advertising systems. They all want to capture dollars the advertisers are allocating to exchanges.

In some cases, the sellers set pricing “floors” beneath which they will not accept a bid for their content when they believe they can command a higher price.

In other cases, high-profile publishers with billions of impressions to sell, including Conde Nast and Time, have also constructed “private exchanges,” in which they offer ads only to a limited set of choice clients instead of on the open market.

Some are also using “yield management” platforms, which evaluate impressions individually to determine whether each one will get more money on an exchange, an ad network or via a direct deal a salesperson has closed with an advertiser.

“Yield management on an impression basis can decide of the three available revenue streams which can provide the most value,” Paul Dolan, managing director for North America* of Xaxis, an advertising buying company that spends many thousands of dollars on exchanges, told me in an interview.

Future: Concerns, Sophistication

Privacy advocates, not surprisingly, are nervous about all the tracking, and bristle at the idea of advertisers and merchants collecting and using data, despite promises it’s all anonymized.

If current legislation being explored in Washington is passed, the advertising exchange industry could take a huge hit.

And though the evolving ecosystem is what Battelle called “rife with opportunity,” he also called it “riddled with fraud,” citing automated bots that mimic humans, invisible tracking pixels, and ads shown in places no human sees them.

Major publishers, exchanges and ad networks have been working with the IAB industry trade group to solidify standards and certify the upstanding participants in the marketplace.

As IAB standards take hold, and more premium publishers release ad inventory, higher profile brand names have also increased their spending levels. Major hotel chains, brewers, soft-drink brands and telecom companies have all served both static and video ads into advertising exchanges within the past year.

Publishers, in turn, have become more assured they can command reasonable prices and have quality ads that look appropriate next to their content, and fewer of the flashing lights and blinking types of junk ads we’ve all seen on occasion.

It’s a sure bet that the predictions of increased dollars flowing through exchanges are correct, and that more sophisticated technologies will emerge.

We will likely see a day when ad spots are bought and sold via options and derivatives, with sophisticated machine trading that mimics NASDAQ and the NYSE. Experiments along these lines have already begun.

Let’s hope that when that happens, the algorithms create real value — enhancing people’s experiences as they consume their favorite news and entertainment — while respecting privacy and stamping out fraud.

*NOTE: This story has been updated to correct the title for Paul Dolan of Xaxis.

An award-winning former managing editor at ABCNews.com and an MBA (with honors), Dorian Benkoil handles marketing and sales strategies for MediaShift, and is the business columnist for the site. He is a founder at Teeming Media, a strategic media consultancy focused on attracting, engaging, and activating communities through digital media. He tweets at @dbenk and you can Circle him on Google+.